Poplar Homes

residents enjoy

Find a place you can call home

Renting a home has been set to easy mode

Use your personalized Resident Dashboard to access all you need for your space—all in one place.

Find, lease, live seamlesslywith Poplar Homes

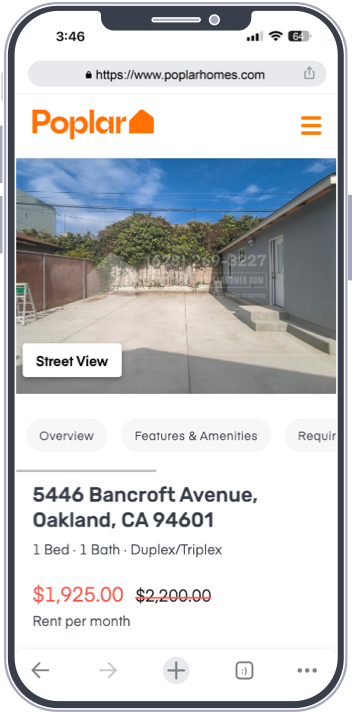

Our local professionals visit every Poplar Home to verify it is habitable, safe, and clean. Plus, we take high-quality photos and 3D scans to represent the property in our listings accurately.

Poplar Homes lets you schedule a self-guided tour to visit your future home at a time convenient for you. Or, you can tour anytime, anywhere with our virtual 3D tours.

Tired of landlords not picking up when you need them? When you live in a Poplar home, a dedicated maintenance team is always on standby to answer your calls– night or day.

Rent a Poplar Home in 3 easy steps

You can browse our quality listings with confidence– we verify that all homes meet Poplar’s high standards. Tour from anywhere with online photos and 3D scans. Want to visit in person? Schedule a self-guided tour at your convenience.

Once you find a home you love, simply click Apply Now on the listing. Create a Resident Account, fill out your application to get approved, and sign your lease online.

Your home comes thoroughly cleaned and move-in ready. We leave your keys in a secure lock box and give you the code, so you can move in anytime. Pay rent, request maintenance, and access 24/7 support on your Resident Dashboard.

Save up for a home while you rent with StreetCred