The arrival of the novel coronavirus has had the opposite effect seen in other cities. San Francisco’s real estate remains healthy in the face of record unemployment numbers and crippling shutdowns.

The decision to rent versus sell a home is never easy, but a competitive market combined with the benefits of San Francisco property management can make for a very rare and lucrative opportunity. Poplar Homes’ rent estimate tool can help you do the math to see which option is best for you.

San Francisco Current Market Conditions

Of San Francisco’s nearly 882,000 residents, the U.S. Census officially reports that less than 38% are homeowners. It could be because the average home value is almost $1.1 million, with a monthly mortgage of almost $3,500.

It’s no small change, especially in a time of crisis. It is a wealthier demographic that is buying homes, not condos, and COVID-19 has not been a deterrent. Even during a global pandemic, San Francisco is experiencing a healthier real estate market than many other areas in the U.S.

| For Sale | |

| Total Homes Available | 1,439 |

| Median Home Value Estimate | $1,194,300 |

| Home Value Forecast | 1.5% |

Inventory Shortages

One-third of San Francisco buildings are apartment buildings, the rest mostly townhouses, and single-family homes. Inventory is a real problem, so it’s not so much when to buy but what to buy.

One-third of San Francisco buildings are apartment buildings, the rest mostly townhouses, and single-family homes. Inventory is a real problem, so it’s not so much when to buy but what to buy.

Most construction was built during the 1960s, and the city has not experienced any kind of serious growth since then. There has also been a sharp increase in the cost of construction materials, further pushing out any new development with 85% markups since April alone.

This impacts the rental market due to the laws of supply and demand. The shortage of housing inventory can make your vacant property in San Francisco more lucrative for renters. The inequality of supply and demand can continue to be in your favor in 2020 as a rental property is still in need in most San Francisco neighborhoods. If your property is a rent-controlled unit, it may be difficult to be cash-flow positive due to the pricing cap on your home. If your property is not rent controlled, you may have more freedom to list your home at the market value in your neighborhood.

The larger picture of keeping a rental property is using the home for retirement. Compared to other investment vehicles, such as your 401k, stocks, IRA, real estate assets are the most resilient over time. By the age of retirement, you could be living mortgage-free because your renters have paid off your debt over the years.

The San Francisco Renter’s Market

San Francisco remains one of the most thriving cities in the U.S., thanks in part to its steady finance and IT industries.

It is the second-most densely populated city in the U.S. as a highly walkable city with great transportation. That makes housing attractive in all parts of the city and not just downtown, like other metro areas. Renters love that it’s easy to get to and from work and anywhere else you need to go. Coupled with a 9.2% decrease in rent, San Francisco today is all the more attractive to the new renter.

Don’t be mistaken, however – rent is still incredibly high in San Francisco. Rent currently averages $4,500 per month in San Francisco, while the greater San Francisco-Oakland-Hayward Metro area averages $3,300 per month. The citywide property shortages are bleeding over into the rental market, with would-be buyers forced into another year of renting simply because they can’t find the right home to buy.

Check Poplar Homes’ rent estimate tool to see what rental prices are going for in your neck of the woods.

The San Francisco Seller’s Market

The San Francisco seller’s market is on fire.

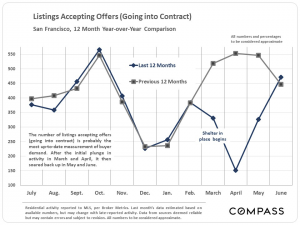

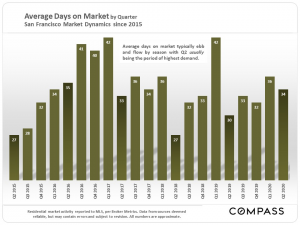

Homes are in hot demand, with many homeowners receiving multiple offers and even waived contingencies. Homes don’t even last a month on the market, averaging just 22 days with an average sales price of $1.52 million in June 2020. That makes for 2.7% growth since this time last year, leading Redfin to rate San Francisco a very competitive 90 out of 100 on their Compete ScoreTM model.

Homes are in hot demand, with many homeowners receiving multiple offers and even waived contingencies. Homes don’t even last a month on the market, averaging just 22 days with an average sales price of $1.52 million in June 2020. That makes for 2.7% growth since this time last year, leading Redfin to rate San Francisco a very competitive 90 out of 100 on their Compete ScoreTM model.

You might want to break out the pocketbook though – most homeowners come to the table with a 30% down payment.

Zillow reports slightly different numbers, but they are no less impressive. The Zillow Home Value Index for San Francisco is $1,447,191, up 3% since last year, but aspiring buyers should beware.

Zillow is also calling for a -2.3% drop by next year, which can affect the many buyers in 2020 that are rushing to take advantage of low post-COVID interest rates. Foreclosures in San Francisco could be common in the coming years, even though the city currently sits far below national averages.

San Francisco’s Most Expensive Neighborhoods to Buy

| Neighborhood | Average Price |

| Lake | $2,269,800 |

| Forest Hill | $1,952,900 |

| Cow Hollow | $1,860,600 |

*Zillow, accessed 07/13/2020

San Francisco’s Most Affordable Neighborhoods to Buy

| Neighborhood | Average Price |

| Downtown | $2,269,800 |

| Excelsior | $876,200 |

| Ingleside | $882,400 |

*Zillow, accessed 07/13/2020

Benefits of San Francisco Property Management

Property management in San Francisco has always been a vital tool for many reasons, like convenience and guidance, but now it has taken on new meaning since coronavirus has run rampant.

Among their many traditional services, San Francisco property management can also provide extra protection in light of the COVID Age.

This can include things like rent relief, eviction, and sanitation procedures.

Whether you are a new homeowner or an expert investor expanding your portfolio, you can benefit from the support of property management in San Francisco’s bustling neighborhoods.

Trusted, experienced professionals can expertly handle virtual showings and open houses while you vet renters from the comfort of your home. It still includes all of the usual services, like communicating with current and potential tenants and vendor management. Poplar Homes’ rent estimate tool can also help you keep your finger on the pulse of the rental market, so you know when you need to adjust your prices.

Life is complicated enough during these crazy times; Poplar Homes’ San Francisco property management can simplify the process.

The Final Word

If you can find the right available property to buy, there’s no denying that interest rates are at record lows, creating a viable opportunity for qualified buyers. If you are not forced to sell your home, then we advise not to. Keeping your second home as a rental property investment in San Francisco can be a strategy for passive income. San Francisco will continue to be a desirable city as tech and financial giants continue to rise.

As the largest property management company on the West Coast, Poplar Homes is uniquely equipped to masterfully navigate the San Francisco real estate market, regardless of whether you want to buy, sell or rent.

Poplar Homes’ San Francisco property management tool is specifically designed to follow, analyze, and interpret the real estate market, making it easy to identify emerging trends so you can act without delay.

With Poplar Homes, you can make better financial and real estate decisions so you can leverage San Francisco’s red-hot market into your own gains.

Recent Comments